Become someone's Tax Hero today!

What is a Tax Hero?

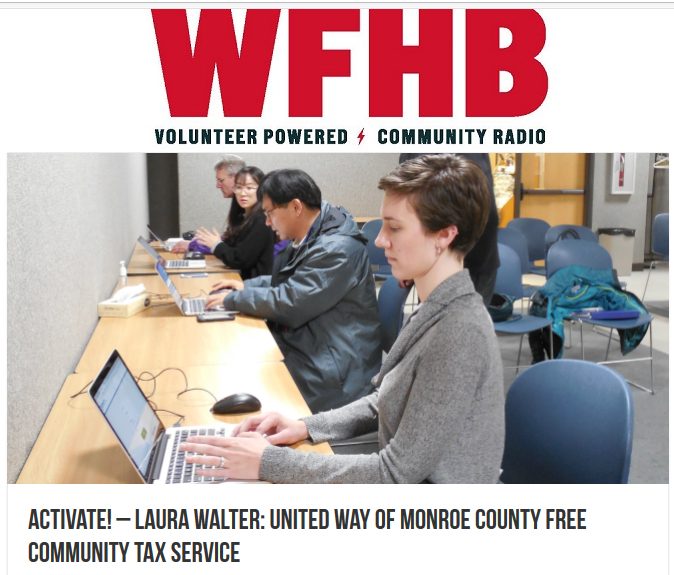

Not all heroes wear capes. Some volunteer to help hardworking families get ahead financially by filing their taxes for free!

The Free Community Tax Service provides FREE federal and state income tax preparation to low- and moderate-income residents from January to April each year. Volunteers will screen clients during an intake and interview process, prepare tax returns, and conduct peer review on returns for quality assurance. No prior experience necessary! Volunteers will receive training in income tax law and tax preparation and become IRS-certified.

Read the Tax Hero Volunteer Description for more information on what it takes to become someone's tax hero, and visit unitedwaysci.org/freetaxes-sites to see a list of locations and hours.

Become a Free Community Tax Service Hero!

Complete this Tax Hero application to start the process of becoming a Tax Hero. Training and Certification will begin in late November - early December.

Being a Tax Hero is a rewarding way to learn new skills, make friends, and strengthen the community.

Watch this short video to learn more about the importance of being a Tax Hero:

Training Central

2025-2026 Training Materials are currently in progress! Please see below for those that have been released.

Volunteers will be able to attend training for the 2025 tax season either in-person or virtually.

Working with Taxpayers 101

Watch the training recording here *Updated Dec 2025 **

This quick class will inform volunteers how to work with all types of taxpayers, especially while handling sensitive information. This class is useful to help you feel comfortable when you first sit down to work one on one with taxpayers.

VITA: Kick-off Meeting

Watch the training recording here

Come meet your fellow Tax Heroes and site coordinators as we gear up for the 2024 tax season. You will get information and updates on the program and have the opportunity to ask questions. You will also be able to pick up your training materials at the meeting, if you would prefer hard copies.

Tax & Software Class

Watch the training recording here

Ivy Tech Accounting and Tax Professors host a free class which you can attend in person, virtually by zoom, or watch the recording. They will lead you through the basics of tax law, how to pass the certification test, and how to use TaxSlayer, the IRS provided tax software you will use to prepare returns during tax season.

For all Tax Heroes:

Link & Learn Getting Started Guide

Free Community Tax Service Training & Certification Step-by-Step Guide **UPDATED Dec 2025 **

Prosperity Now VITA Training: **UPDATED Dec 2025 **

This is free online training curriculum features 12 plug-and-play modules designed to help volunteers prepare for the IRS Basic Volunteer Certification Test. It also includes a module for returning volunteers with updates on the new tax laws and several Advanced Certification topics.

VITA Training Site: Access study guides, quizzes, videos, and a google form where you can enter your answers to the certification test and check yourself before you take the test through Link and Learn.

Using the Practice Lab (TaxSlayer Guide)

Indiana State Volunteer Handbook (For State Returns)

Required only for Intake Specialists:

For Call Takers:

Site Coordinators Corner

IRS page for site coordinators

ACA Affordability Calculator: This tool can help tax preparers determine eligibility for ACA exemptions.

AARP Tax-Aide Tool List: Helpful calculators and tools that go above and beyond TaxSlayer

Child Care Tax Credit Information: Understanding Letter 6419

Property Tax Look-Up:

- Publication 4491, VITA/TCE Training Guide

- Publication 4012, Volunteer Resource Guide

- Publication 17, Your Federal Income Tax for Individuals

- Form 13614-C, Intake/Interview Sheet & Quality Review Sheet

- Publication 4299, Privacy, Confidentiality, and Civil Rights – A Public Trust

- VITA, Volunteer Tax Alerts and QSRA, Quality Site Requirement Alerts

Tax Hero Volunteer Coordinator

Carmen Chamorro Avilés, Community Impact Manager

United Way of South Central Indiana

431 South College Avenue

Bloomington, IN 47403

carmen@unitedwaysci.org

(812) 269-1018